Introduction:

Cryptocurrency transactions in India are now subject to stringent taxation regulations, necessitating a nuanced understanding of the associated implications. This article delves into the key takeaways, recent updates, and practical aspects of crypto taxation, empowering investors to navigate this evolving landscape with confidence.

Key Takeaways:

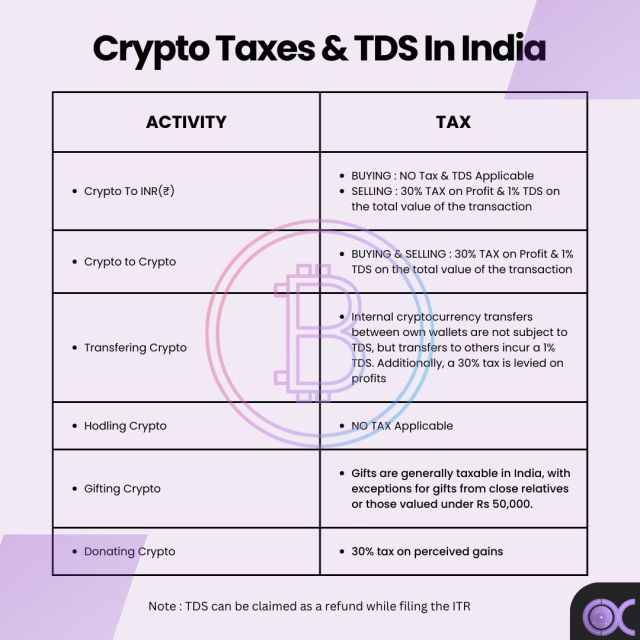

- Tax Rate and Applicability: In India, profits from crypto transactions are taxed at a flat rate of 30%, along with applicable surcharges and a 4% cess, as per section 115BBH of the Indian tax code.

- Long-Term Gains and Deductions: Unlike traditional investments, there are no provisions for lower tax rates on long-term capital gains for crypto assets. Deductions are limited to the cost of acquisition.

- Tax Deducted at Source (TDS): A 1% TDS is applicable on the transfer of Virtual Digital Assets (VDAs) since July 1, 2022, ensuring compliance and streamlining the taxation process.(TDS can be claimed at ITR filing)

Budget 2023 Crypto Tax Update:

The Union Budget 2022 laid the foundation for India’s crypto tax laws, categorizing crypto assets as “virtual digital assets.” The taxable events, as outlined in section 115BBH of the Finance Bill, include conversions to fiat currency, crypto-to-crypto trading, and using virtual digital assets for goods and services. The tax rate remains at 30%, with an additional 1% for transactions exceeding INR 10,000.

Crypto Taxation in India Explained:

- Income Tax Implications: All gains from the transfer of virtual digital assets, including crypto and NFTs, are taxed at 30%, with only the cost of acquisition eligible for deduction.

- Gifting and Losses: Gifting digital assets incurs tax on the receiver, and losses from one digital currency cannot be set off against income from another. The 1% TDS, introduced in Budget 2022, is also applicable.

- Special Provision (Section 206AB): If a user hasn’t filed their Income Tax Return in the last two years and TDS is INR 50,000 or more in each of these years, the TDS for crypto transactions is at 5%.

How Much Tax Will You Pay on Crypto in India?

- TDS Application: Effective from July 1, 2022, the 1% TDS is deducted from the final sale amount, irrespective of profit or loss.

How is the 30% Crypto Tax Calculated in India?

- Flat Rate: The 30% tax is levied on all profits from the transfer of virtual assets, regardless of the nature of income or holding period.

Example: Let’s say you invested INR 1,00,000 in cryptocurrency at the start of the fiscal year 2022. As the fiscal year concluded, you sold the cryptocurrency for INR 2,00,000, resulting in a profit of INR 1,00,000. In this case, there’s a fixed 30% tax on this profit. As an investor, you’d be responsible for paying INR 30,000(plus surcharge and cess) as your crypto income tax for that financial year.

When Do You Have to Pay 30% Tax on Crypto?

- Taxable Scenarios: Selling crypto for fiat currency, trading crypto to crypto tokens, or spending crypto on goods and services all incur a 30% tax on profits.

Staying TDS Compliant:

- Union Budget 2023 Update: No new changes were introduced, but penalties for TDS non-compliance were reinforced. If a user has not submitted their Income Tax Return for the preceding two years and the total TDS amount exceeds INR 50,000 in each of these two preceding years, the applicable tax deduction rate for Crypto-related transactions will be 5%.

- Cryptorbex’s Approach: Cryptorbex facilitates TDS compliance through a streamlined procedure, offering users easy access to TDS statements, summaries, and certificates within the website. TDS will be deducted by Cryptorbex and deposited with the government. So the Cryptorbiters won’t have to worry about filing TDS themselves.

Conclusion:

Navigating crypto taxation in India demands a thorough understanding of the tax implications and compliance requirements. By staying informed and leveraging platforms like Cryptorbex, investors can ensure seamless adherence to regulatory frameworks, fostering a responsible and transparent crypto ecosystem.